|

JOIN OUR MAILING LIST |

|

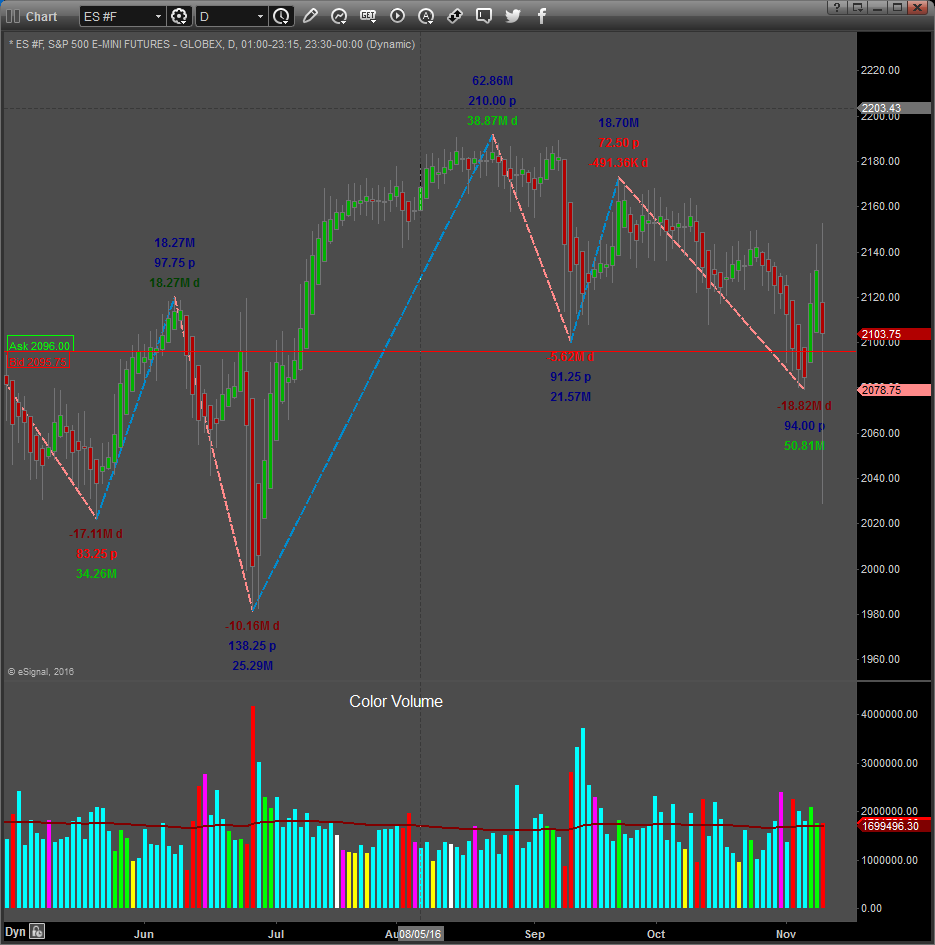

Assessments / Blog 2018-10-13 ES #F Demand but Average Volatility still high The daily chart of the S&P 500 mini futures contract above shows our proprietary SUPPLY and DEMAND Dashboard and BXB (Bar by Bar) Signals using data from the NYSE. Demand had the upper hand Friday at the end of the session and price gained 23.00-points. The expected rebound was muted and price stayed in the range of the previous bar (inside bar) closing at 2768.50. Volatility is still high, but if it settles down, we expect a move into the 2803.00 to 2847.00 area. The broader market (NYSE) closed higher on Friday, with 53% of stocks above their Volume Weighted Average price (VWAP). Up from 26% the previous day. Selling pressure has eased, but should it increase and high Volatility is maintained, more weakness can occur. Daily Signals October the 12th: S & D Dashboard Algorithm turned Bullish except for average Volatility but Daily Signals all turned Bullish Average Volatility: Still Bearish at 204% Caution: A deeper pullback to the upside followed by more weakness is a possibility. If Volatility settles down, sideways movement with range bound up and down swings is a possibility for some time.

Link to Facebook Group where these assessments are also posted regularly. Click here for example of reversal trade taken in Feeder Cattle that can be found on this page. CLICK ON THIS LINK OR CHART ABOVE TO LEAR MORE…… Source: RISK DISCLOSURE: The information delivered here is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, futures or other securities referenced. All references are for illustrative purposes only and are not considered endorsed or recommended for purchase or sale by MC Trading. Trading Forex, Stocks and Options, Futures and any Commodity, Crypto or ETF contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. MCTrading has taken reasonable measures to ensure the accuracy of the information contained herein and on this website, however MCTrading does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or from an inability to access such information or any delay in or failure of the transmission or receipt of any instruction or notification in connection therewith. |