|

JOIN OUR MAILING LIST |

|

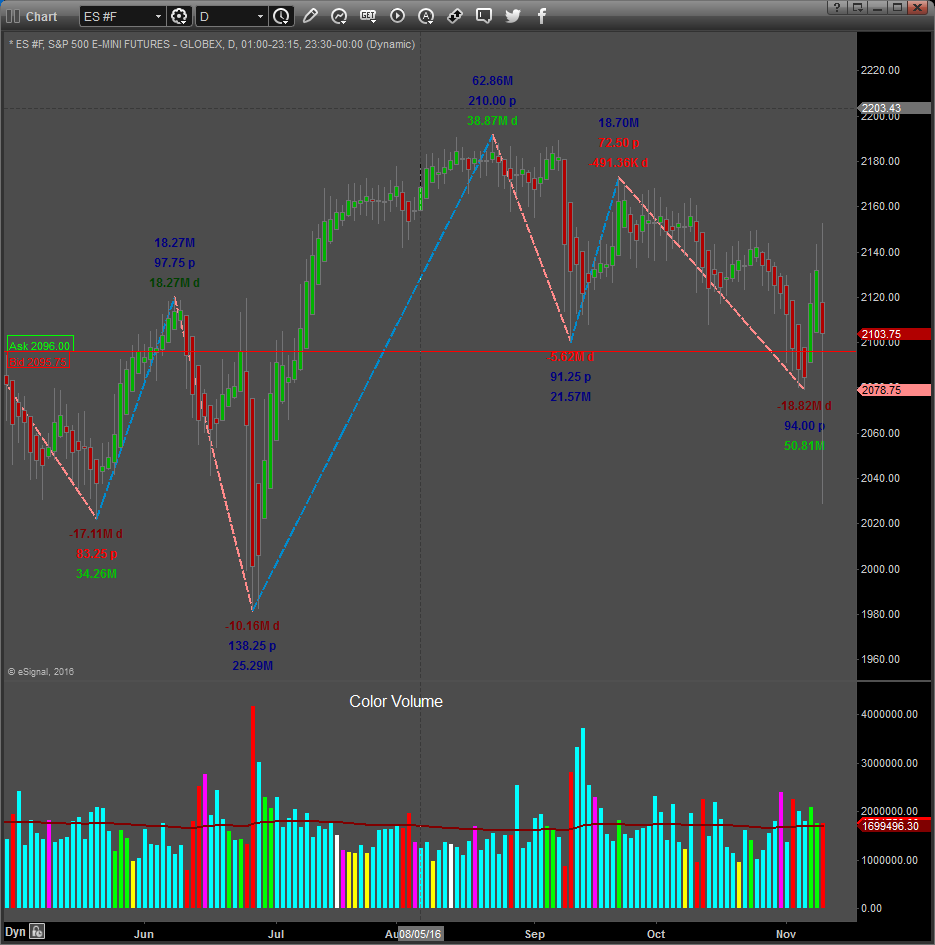

Assessments / Blog 2018-12-11 ES #F Supply, sell-off and bounce back Yesterday the ES lost 53.00-points and made a low of 2583.00 (taking out the October low), before closing up 5.50-points at 2641.50. Volatility is still in Bearish territory but eased. Simplified volume is still in Selling pressure territory and the Supply/Demand Sentiment came out of “Fear” territory. On the comparative strength/weakness analysis, the ES still shows weakness, but is at extreme levels. A Spring formed Yesterday and a move higher is expected, although all the recent Springs in the current down trend, only resulted in a pullback, where after the down trend continued. A test of Yesterday’s low could also be expected. A rally should find resistance in the 2712.00 to 2762.50 area. A bar close above 2814.00 should threaten the current down trend. Daily Signals December the 10th: S & D Dashboard Algorithm is still Bearish, but the Daily Signals turned Bullish Caution: Comparative weakness is still at or near extreme levels, and a pullback to the upside is possible, in which case we expect resistance in the 2712.00 to 2762.50 area.

Link to Facebook Group where these assessments are also posted regularly. Click here for example of reversal trade taken in Feeder Cattle that can be found on this page. Click on this link to read more....

Source:

|