|

JOIN OUR MAILING LIST |

|

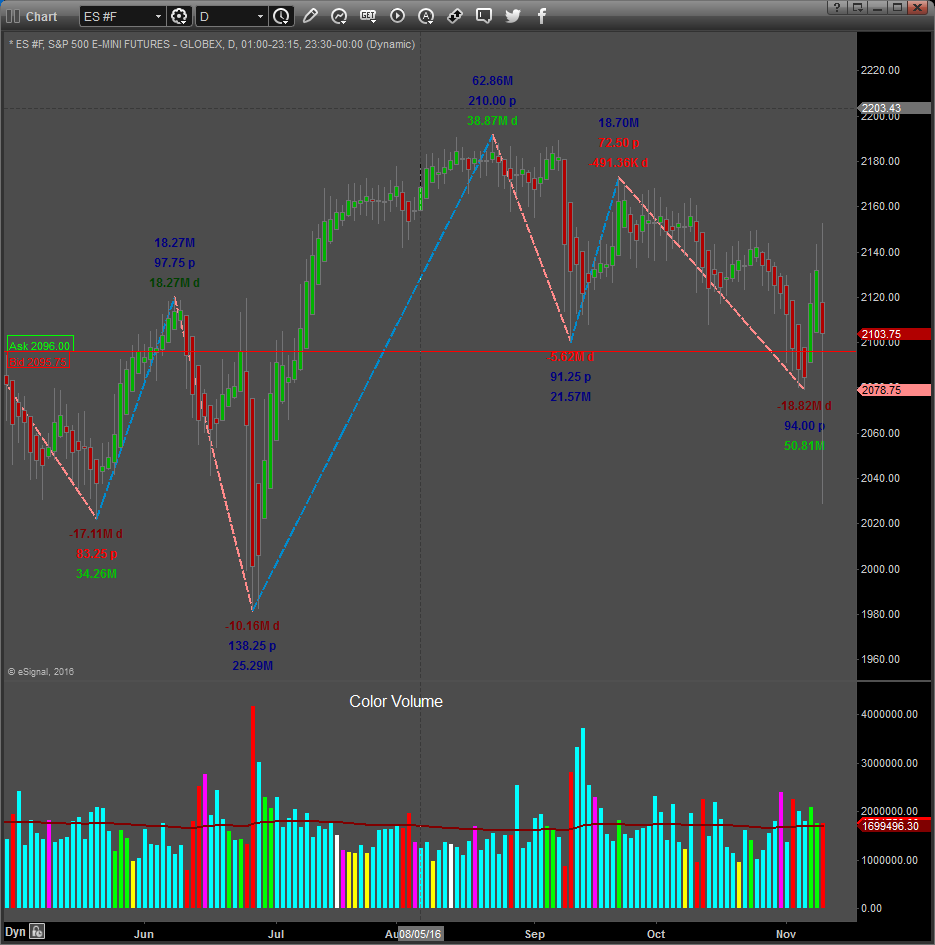

Assessments / Blog 2018-12-22 ES #F Strong Supply into wall of support The ES closed down 65.00-points on Friday into a strong support zone, with heavy Supply. The close came in at 2421.25, with the day’s low at 2409.25 Our new phase 2 targets according to our swing system to the down side are: 2431.00 (taken out), 2391.00 and 2364.00. These are targets for swing trading, if Supply continues to dominate. We are still in Selling pressure territory and no signs that selling pressure is easing, with the ES still at very weak levels according to our comparative strength analysis. Supply/Demand sentiment is in the “Fear” zone. Price reached the bottom of the Elliott wave trend channel and a near-term bounce to the upside is possible soon. Friday was also earmarked by a wide range “Smart money” down bar, which normally have Bullish consequences. Resistance to the upside is identified at 2508.00, 2521.75, 2542.50 and 2583.00. Bigger Picture: From the swing low on October the 29th, we have drawn a zig-zag in black forming a M-pattern (Bearish), where the “Smart money bars” occurred near or at bottoms and tops. This clearly illustrates where the “Smart money” was more active, causing a swing effect up or down. The last down move started on December the 3rd (vertical white line), with a small Divergence in Buying/Selling pressure, with Buying pressure diminishing and thereafter Selling pressure developing. The oscillator clearly sloped down all the way from that date indicating weakness, with consequently downward price movement. Our Supply/Demand algorithm shows how Supply started to dominate on December the 4th, dominating 13 of the following 14 trading days. During this time the market only closed higher 3 times, but not significantly higher, with the highest gain only 11.25-points on the close. The average volatility (of Supply and Demand) was also in Bearish territory from December the 4th all the way until currently, with the exception of one day, where it was at 92 (below 100), but near the 100 mark. The swing points are also characterised by movement into the “Greed” (Overbought) and “Fear” (Oversold) zones on the Supply/Demand Sentiment tool, sometimes early and warning that a possible direction change will occur. The Comparative Strength Tool on top also showed weakness of the ES compared to the Dollar Index, since December the 4th all the way. All the above have painted a near perfect Bearish picture! End of the day Signals December the 21th: S & D Dashboard Algorithm is Bearish and the Daily Signals all turned Bearish These readings are an independent assessment of the one and only measureable fundamental market mover: SUPPLY and DEMAND. It does not matter if price is influenced by a geopolitical event, seasonality, fundamental economic data releases or sentiment driven news, etc. It all reflects in Supply and Demand, the “footprints” of the “Big Boys” or “Smart Money”. Caution: Volatility went up, so wild price swings may continue. A move to the upside is a possibility.

Link to Facebook Group where these assessments are also posted regularly. Click here for example of reversal trade taken in Feeder Cattle that can be found on this page.

Click on this link to read more....

RISK DISCLOSURE: The information delivered here is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, futures or other securities referenced. All references are for illustrative purposes only and are not considered endorsed or recommended for purchase or sale by MC Trading. Trading Forex, Stocks and Options, Futures and any Commodity, Crypto or ETF contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. MCTrading has taken reasonable measures to ensure the accuracy of the information contained herein and on this website, however MCTrading does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or from an inability to access such information or any delay in or failure of the transmission or receipt of any instruction or notification in connection therewith.

|