|

JOIN OUR MAILING LIST |

|

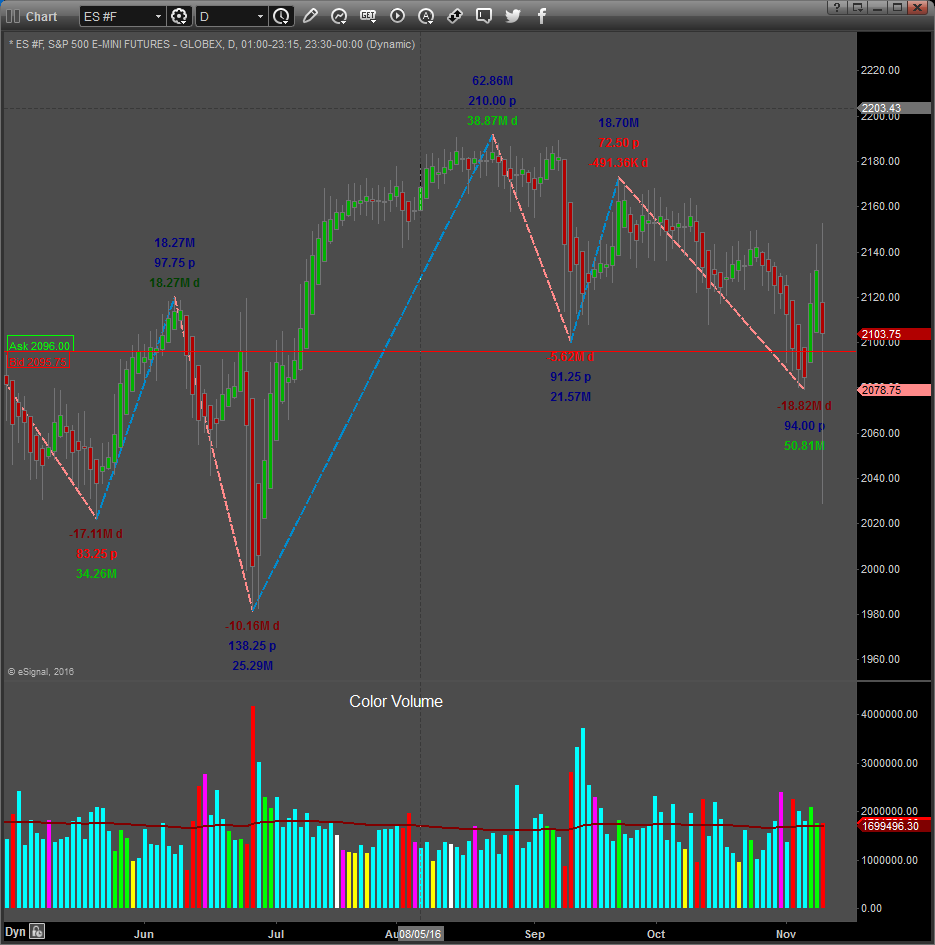

Assessments / Blog 2019-05-21 GLOBAL ECONOMIC TENSIONS TRANSLATE INTO OIL VOLATILITY Our most recent multiple-part research post regarding the current global economic environment and how EU elections, US/China trade issues and a very contentious US Presidential Election cycle are poised to continue driving increased price volatility just hit the digital medium last weekend (https://www.thetechnicaltraders.com/us-vs-global-sector-rotation-what-next-part-ii/ ). We urge all of our followers to read this detailed article about how a series of global events are stacking up to create incredible opportunities for skilled traders. Today, we are focusing on Crude Oil because our proprietary adaptive learning Fibonacci modeling system is suggesting a surge of massive volatility is very likely to happen over the next few months in Crude Oil and we believe the DOWNSIDE price risk is the most likely outcome at this point. Fibonacci price theory dictates that price must ALWAYS attempt to seek out new price highs or new price lows – ALWAYS. We interpret this price requirement as the following: “Tracking major price peaks and valleys, one can determine if the price is currently achieving new higher high price levels or lower low price levels (thus continuing the price trend) or failing to reach these new higher high or lower low levels. Any failure to reach new higher highs or lower lows is a warning that price may be attempting to continue a previous price trend or reversing.” This Weekly chart of Crude Oil clearly illustrates our thinking in terms of this Fibonacci price theory component and other technical aspects. The CYAN price trend line (downward sloping) suggests a failure to establish any new price highs over the longer term trend. Additionally, the recent downward price rotation suggests price weakness may be returning to Crude Oil. Pay very special attention to the Fibonacci price projection levels on the right side of this chart. Notice that the upside price projections start near $74 and the downside price projections start near $33. This is an incredible $41 price range in Crude Oil and this very wide Fibonacci projection range suggests massive volatility is about to hit. Click on this link to read more... |