|

JOIN OUR MAILING LIST |

|

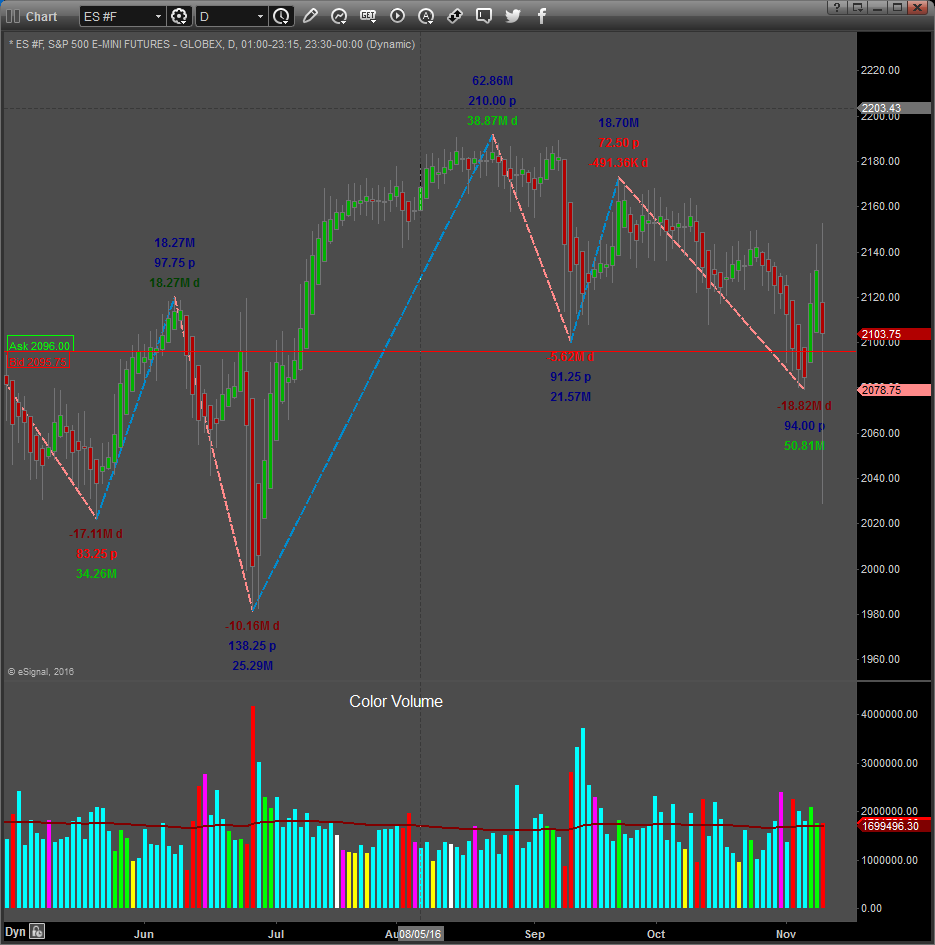

Assessments / Blog 2018-12-18 ES #F Strong Supply and a go at February low The ES lost 49.75-points Yesterday, closing at 2555.75 (March 2019 contract), made a low of 2533.50 and came within a few points of the February low at 2529.00 (The bigger S & P 500 Index made a new low Yesterday for the year). The April low at 2552.00 and our targets at 2567.25 and 2542.50 were taken out. All our targets except for 2474.75, identified with our proprietary swing system from as early as 19 October 2018 were reached. We are still in Selling pressure territory, but there are signs of reversing to Buying pressure, and Supply / Demand Sentiment is at the “Fear” (oversold) level. The comparative strength/weakness analysis, is still at extreme weak levels, but possible signs of easing. Previously we mentioned: “The $TRAN (Transportation Index) made a new low, whilst the ES did not make a new low? One could argue that the ES is the stronger one, but given the fact that the $TRAN is most of the time leading the market, the possibility is high that the ES will catch up to the down side. Friday the $TRAN again made another new low, whilst the ES did not?” The ES did catch up with the $TRAN as expected Yesterday, and the previous swing low was taken out. The $TRAN came very close to our target level Yesterday. If a bounce from here occurs, a close above 2686.50 will threaten the near-term down trend, but resistance can be expected at the 2627.50 to 2648.75 area. Update: ES is trading 0.75 points below Yesterday’s close at the time of this update (Asian time zone) and the overnight volume has exceeded Yesterday’s total volume already, but price did not move significantly higher. Is this a sign that all the buying is absorbed by the Sellers and a sudden move lower is a possibility or a sign of bag holding (All the selling is absorbed by the Buyers for a move higher)? Bag Holding: Narrow down bar with very high volume. Bar must close down into fresh new ground. So far the current bar is an inside bar and has not moved into fresh new ground (lower than previous bar). Bag holding does not occur very often. The professionals suddenly mark the price down to collect stops and to panic the “herd” to convince them to sell at low prices, “holding out an open bag to collect from the sellers at these low levels”. Daily Signals December the 17th: S & D Dashboard Algorithm is Bearish and all the Daily Signals are Bearish Caution: Comparative strength / weakness reached extreme levels, with Sentiment in the “Fear” (oversold) zone, and we are approaching Buying pressure territory, making a pullback to the upside a possibility. If the year’s low of 2529.00 is taken out, it could spark a sudden sell-off into the 2400.00 levels. If a sudden down move occurs and price move lower than Yesterday’s low, but the range of the bar is narrow (no significant progress to the down side), it could be a sign of “bag holding”, given the high volume on the current bar already.

Link to Facebook Group where these assessments are also posted regularly. Click here for example of reversal trade taken in Feeder Cattle that can be found on this page.

Click on this link to read more.... RISK DISCLOSURE: The information delivered here is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, futures or other securities referenced. All references are for illustrative purposes only and are not considered endorsed or recommended for purchase or sale by MC Trading. Trading Forex, Stocks and Options, Futures and any Commodity, Crypto or ETF contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. MCTrading has taken reasonable measures to ensure the accuracy of the information contained herein and on this website, however MCTrading does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or from an inability to access such information or any delay in or failure of the transmission or receipt of any instruction or notification in connection therewith. |