|

JOIN OUR MAILING LIST |

|

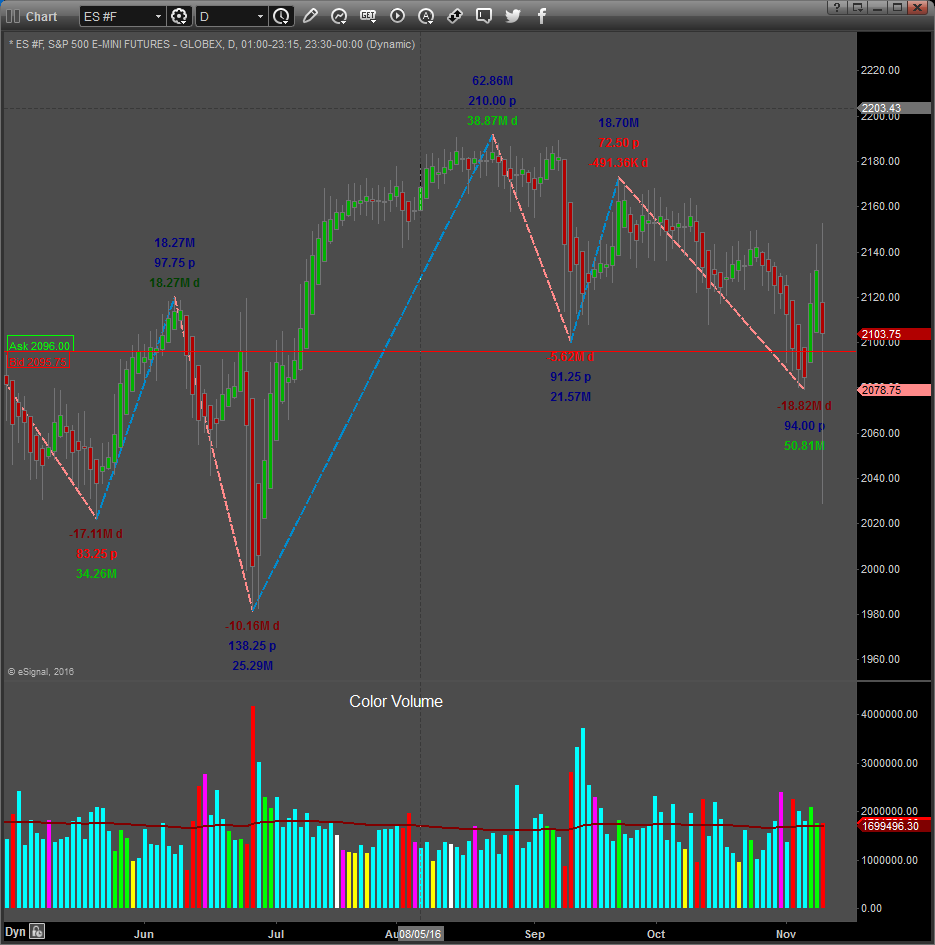

Assessments / Blog 2019-01-21 ES #F Demand at “greed” level The daily chart of the S&P 500 mini futures contract above shows our proprietary SUPPLY and DEMAND Dashboard and BXB (Bar by Bar) Signals using data from the NYSE.

Demand on Friday drove price to close 36.25-points higher at 2671.50 after the high came in at 2677.75, just above our identified resistance at 2676.00. The expected move higher played out. Supply and Demand Algorithm is still Bullish, but the daily signals were mixed. A Divergence to the down side in Buying pressure still exists and average volatility reached a climax with the lowest reading since January the 9th. The Comparative strength ratio is also weakening. A pullback may follow soon. Should the market trade downwards, support zones are at 2625.00, 2603.00, 2578.00, 2546.00, 2529.00. End of the day Signals January the 18th: S & D Dashboard Algorithm is Bullish, but the Daily Signals are mixed These readings are an independent assessment of the one and only measureable fundamental market mover: SUPPLY and DEMAND. It does not matter if price is influenced by a geopolitical event, seasonality, fundamental economic data releases or sentiment driven news, etc. It all reflects in Supply and Demand, the “footprints” of the “Big Boys” or “Smart Money”. Caution: The Divergence to the down side in Buying pressure still exists and we are in the “Greed” (Overbought) zone and top of the immediate term trend channel. Keep an eye on Supply and Demand during the trading session.

Link to Facebook Group where these assessments are also posted regularly. Click here for example of reversal trade taken in Feeder Cattle that can be found on this page.

TWO MUST KNOW TRADE SETUPS THAT HAPPEN EVERY WEEK If you don’t know about our two best short term trade setups which are the “Gap Window” and “Price Spike” then you’ll want to learn more and we will be adding a detailed trading guide on exactly how to trade these for our subscribers. WILL CHINA SURPRISE THE US STOCK MARKET? Recently, we openly discussed the potential for global turmoil related to Europe, Asia, China, and South America. The issues before the globe are that the global economy may not be firing in sync and that there are credit and debt, as well as geopolitical, issues that persist. The interesting component of all of this is that the US stock market has staged a very impressive recovery over the past two weeks that have shocked even the best Wall Street analysts and researchers. While the US recovered from elections, the Fed, FANG price collapse and a Government Shutdown, the US stock markets appeared to be falling off a cliff. Then, almost exactly on Christmas Eve, the markets turned around – even in the midst of all of this uncertainty. Now, nearly 3 weeks after Christmas, the US stock market appears to be shaking off the negativity and headed for higher price levels. China announced a plan to eliminate the trade barriers between the US by providing a 10-year plan to gradually eliminate any US trade deficit. Even though China has discussed this plan before, the US stock market ate it up like a starving man on a deserted island. The ES rallied over 3.35% this week. The NQ rallied over 3.0% and the YM rallied over 3.25% week. Click on this link to read more....

|