|

JOIN OUR MAILING LIST |

|

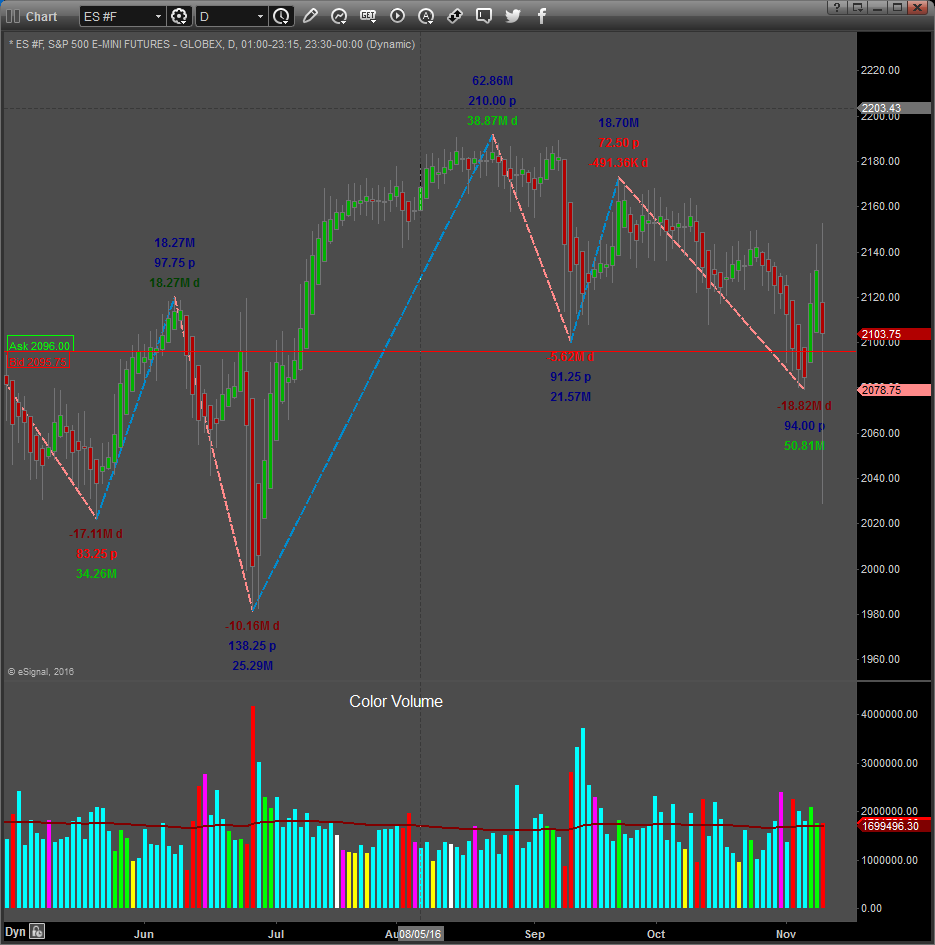

Assessments / Blog 2018-05-20 BTC #F Still Demand The daily chart above shows our SUPPLY and DEMAND Dashboard and BXB (Bar by Bar) Signals for Bitcoin Futures trading on the Chicago Mercantile Exchange. Readings are based on Supply and Demand and Volume internal data. It is updated in real time during the trading session of the CME exchange and does NOT take into account any price indicators or mathematical formulas using price. We do however show the cumulative price change for the trading session and in some instances assess price movement’s relationship to Supply and Demand. It is therefore fair to say that the readings and signals are independent from other popular price indicators and others shown on the chart. The readings are an independent assessment of the one and only measureable fundamental market mover: SUPPLY and DEMAND. It does not matter if price is influenced by a geopolitical event, seasonality, fundamental economic data releases or sentiment driven news, etc. It all reflects in Supply and Demand, the “footprints” of the “Big Boys” or “Smart Money”. We still have a buy signal on the BXB Board (Long alignment on the two Dashboards). Supply can still enter the market as we are still in Selling pressure territory. We also have a buy signal on the 3 Day chart. The readings were taken after Friday’s close of the Future’s market. The BTC futures do not trade over weekends. Daily Signals May the 18th Dashboard: The Supply and Demand Reading (1st row) is 2.4 which indicates Demand have the upper hand the time the reading was taken. Supply and Demand Direction (3nd row) is to the upside (blue up triangle), indicating upwards direction. Average Supply and Demand Volatility (4th row) is below 100% and is bullish. The change in average Volatility from the previous day was positive 14 (demand is getting stronger) as shown on the right of Sup/Dem Dashboard. BXB Signals: We have a buy signal on the signals board (1st row). Daily Volatility direction (2nd row) is Bullish (blue up triangle). The change in daily Volatility from the previous day was positive 37 (demand is getting stronger) shown on the right of BXB Dashboard. Average Volatility direction was Up (blue up triangle in 3rd row). Supply / Demand direction was Up (positive reading in 4th row). So far the 8000 level is holding and we did not see any bar closes below this level. Demand is increasing and the Supply / Demand sentiment tool is sloping upwards, but we are still in Selling pressure territory on the Simplified Volume tool. Resistance identified to the upside is at 9415. We have positive readings on the 3-Day chart. Caution: The 8000 level must hold for price to turn bullish over the longer term. RISK DISCLOSURE: The information delivered here is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, futures or other securities referenced. All references are for illustrative purposes only and are not considered endorsed or recommended for purchase or sale by MC Trading. Trading Forex, Stocks and Options, Futures and any Cryptocurrency, Commodity or ETF contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. MCTrading has taken reasonable measures to ensure the accuracy of the information contained herein and on this website, however MCTrading does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or from an inability to access such information or any delay in or failure of the transmission or receipt of any instruction or notification in connection therewith. |