|

JOIN OUR MAILING LIST |

|

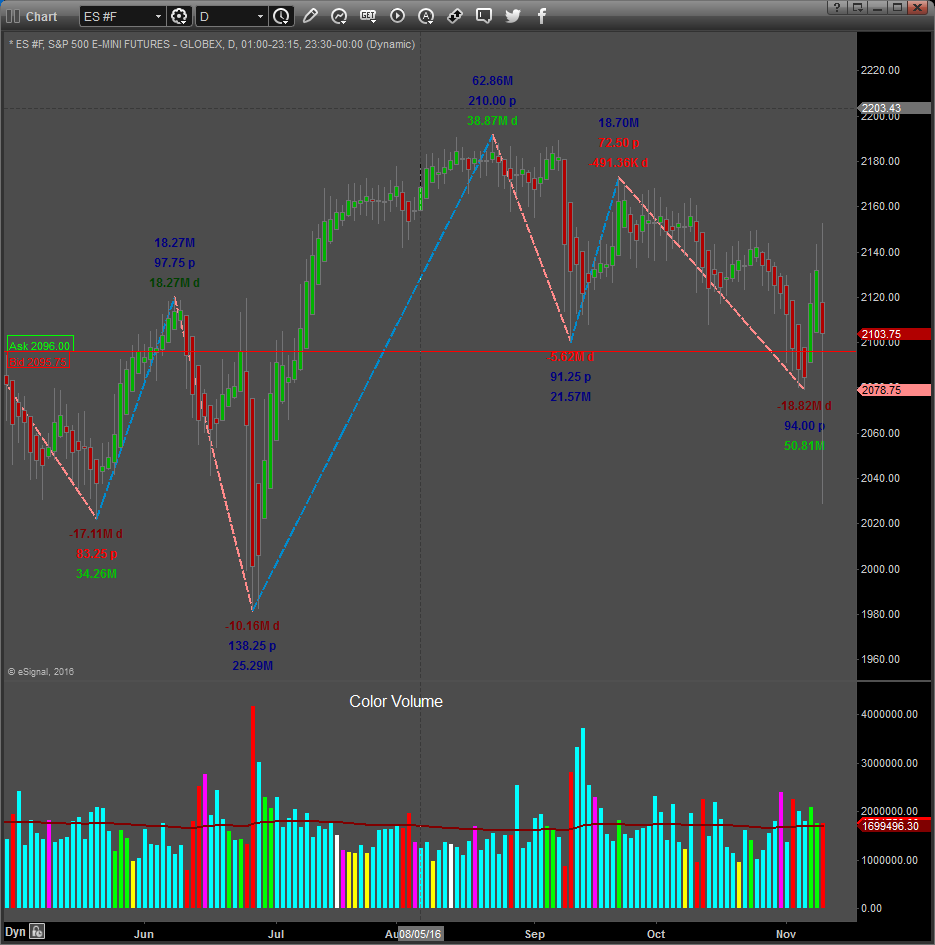

Assessments / Blog 2019-03-13 ES #F Demand weakening Demand weakened Yesterday on a high volume day. The ES closed higher by 8.25-points. Selling pressure is developing, and Comparative strength weakened. Daily signals on the Bar by Bar Dashboard turned to the downside (bearish). The Comparative Strength (CS) Watch list shows some weakness appearing on the short term with the daily CS also weakening. End of the day Signals March the 12th: S & D Dashboard Algorithm Still Bullish Daily Signals changed to the downside These readings are an independent assessment of the one and only measureable fundamental market mover: SUPPLY and DEMAND. It does not matter if price is influenced by a geopolitical event, seasonality, fundamental economic data releases or sentiment driven news, etc. It all reflects in Supply and Demand, the “footprints” of the “Big Boys” or “Smart Money”. Caution: A bit of mixed signals on a high volume narrow range day, but weakness appeared.Today’s price action may give more clarity on which way the market will go. Link to Facebook Group where these assessments are also posted regularly.

IS BRITAIN AT THE EDGE OF A POLITICAL CLIFF?Recent news that Theresa May was unable to convince members of Parliament to even consider her current deal as well as the future political and societal consequences of any failure to move ahead with an orderly Brexit deal. The question before traders and investors is how will this reflect in the global markets and how will currencies react to this news? The GBP (British Pound) appears to be poised to a breakdown move aligning with our Fibonacci Arc structures. These arc structures help us to understand where “inflection points” are likely in the markets and where bigger moves may initiate. The current Arc level, near current price, is indicating that any failure of an upside move will likely prompt a downside move to near 0.739 – or lower. Click on this link to read more.... RISK DISCLOSURE: The information delivered here is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, futures or other securities referenced. All references are for illustrative purposes only and are not considered endorsed or recommended for purchase or sale by MC Trading. Trading Forex, Stocks and Options, Futures and any Cryptocurrency, Commodity or ETF contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. MCTrading has taken reasonable measures to ensure the accuracy of the information contained herein and on this website, however MCTrading does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or from an inability to access such information or any delay in or failure of the transmission or receipt of any instruction or notification in connection therewith.

|