|

JOIN OUR MAILING LIST |

|

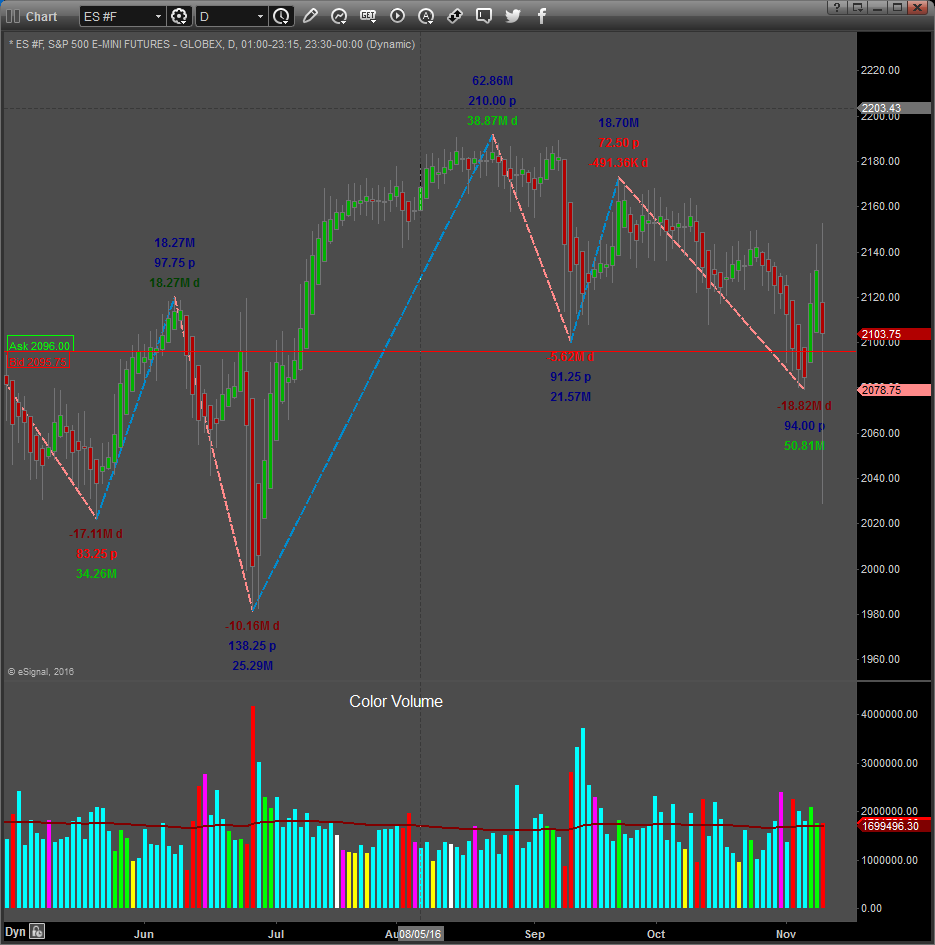

Assessments / Blog 2018-11-13 ES #F Strong Supply with high Volatility The daily chart of the S&P 500 mini futures contract above shows our proprietary SUPPLY and DEMAND Dashboard and BXB (Bar by Bar) Signals using data from the NYSE. In our last assessment we expected another sell-off (if the market stayed below 2766.25) which did not occur until after the 7th , when we had a Kamikaze Up bar with Volatility increasing. Yesterday price went below the 2766.25 level to close at 2730.50 with the ES losing 48.50-points. Supply and Demand Volatility has reached a very high level (climax) Yesterday and Supply/Demand sentiment is at the Fear level (oversold), making an up move today a possibility. In the near term we anticipate another move lower with possible targets at 2567.25 and 2542.50, only if price stay below 2766.25 and we get a bar close below 2712.25. Daily Signals November the 12th: S & D Dashboard Algorithm is Bearish and Daily Signals all turned Bearish Supply/Demand Volatility increased to 264% and the highest for a while which may indicate an extreme

Caution: Supply and Demand Volatility is at a very high level (extreme) and wild price swings are a possibility. A sudden up move today is a possibility.

Link to Facebook Group where these assessments are also posted regularly. Click here for example of reversal trade taken in Feeder Cattle that can be found on this page. WILL OIL FIND SUPPORT NEAR $60? Our research team warned of this move in Crude Oil back on October 7, 2018. At that time, we warned that Oil may follow a historical price pattern, moving dramatically lower and that lows near $65 may become the ultimate bottom for that move. Here we are with a price below that level and many are asking “where will it go from here?”. Click on this link or chart above to read more.... Source: RISK DISCLOSURE: The information delivered here is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, futures or other securities referenced. All references are for illustrative purposes only and are not considered endorsed or recommended for purchase or sale by MC Trading. Trading Forex, Stocks and Options, Futures and any Commodity, Crypto or ETF contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. MCTrading has taken reasonable measures to ensure the accuracy of the information contained herein and on this website, however MCTrading does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or from an inability to access such information or any delay in or failure of the transmission or receipt of any instruction or notification in connection therewit

|