|

JOIN OUR MAILING LIST |

|

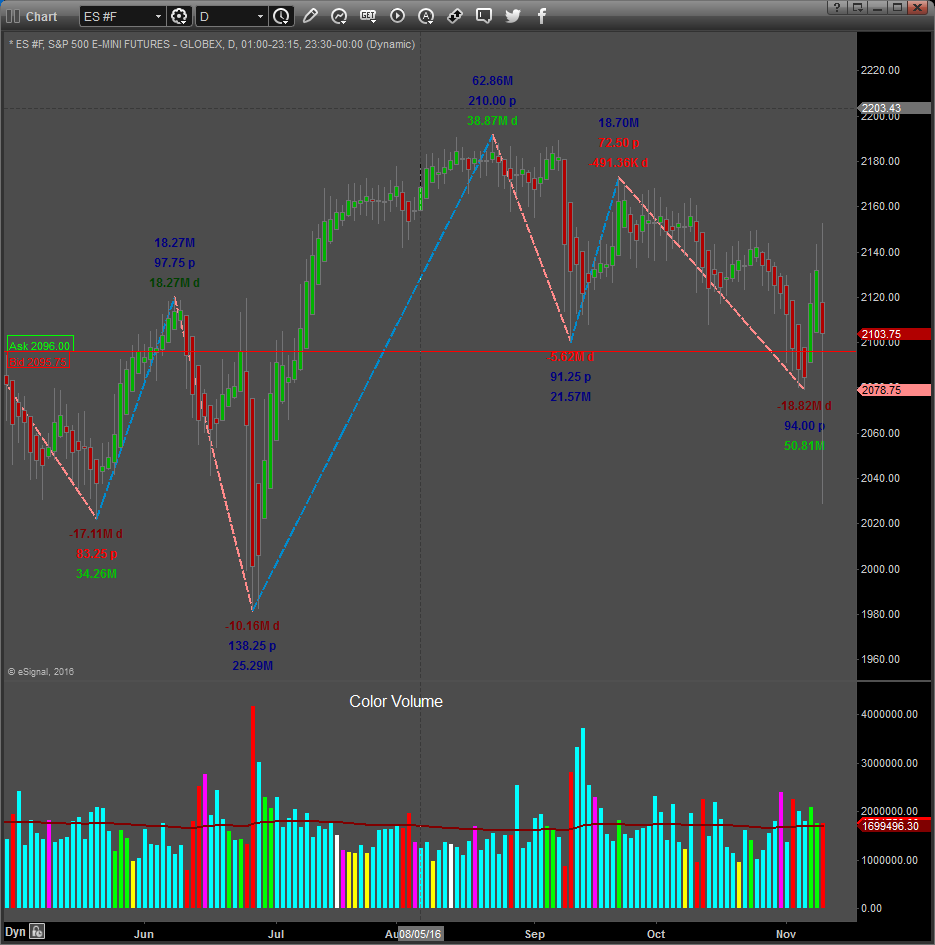

Assessments / Blog 2019-02-08 ES #F Supply emerged In our previous assessment we warned about a possible pullback, which happened Yesterday. Supply emerged and price penetrated the Vertical Acceleration Zone’s low at 2696.00, but closed above it at 2704.00. The ES closed down 25.50-points for the day. Supply dominated for the duration of the trading session, but price did not penetrate the bottom of the near term up trend channel. Volume is increasing and follow through to the downside is a possibility as the S & D Algorithm turned Bearish. Should the market close below 2696.00, our support zones are at 2668.00, 2640.00 and 2626.00. End of the day Signals February the 7th: S & D Dashboard Algorithm turned Bearish, but the Daily Signals are “neutral” These readings are an independent assessment of the one and only measureable fundamental market mover: SUPPLY and DEMAND. It does not matter if price is influenced by a geopolitical event, seasonality, fundamental economic data releases or sentiment driven news, etc. It all reflects in Supply and Demand, the “footprints” of the “Big Boys” or “Smart Money”. Caution: Price is near the bottom of the near term upward trend channel. |