|

JOIN OUR MAILING LIST |

|

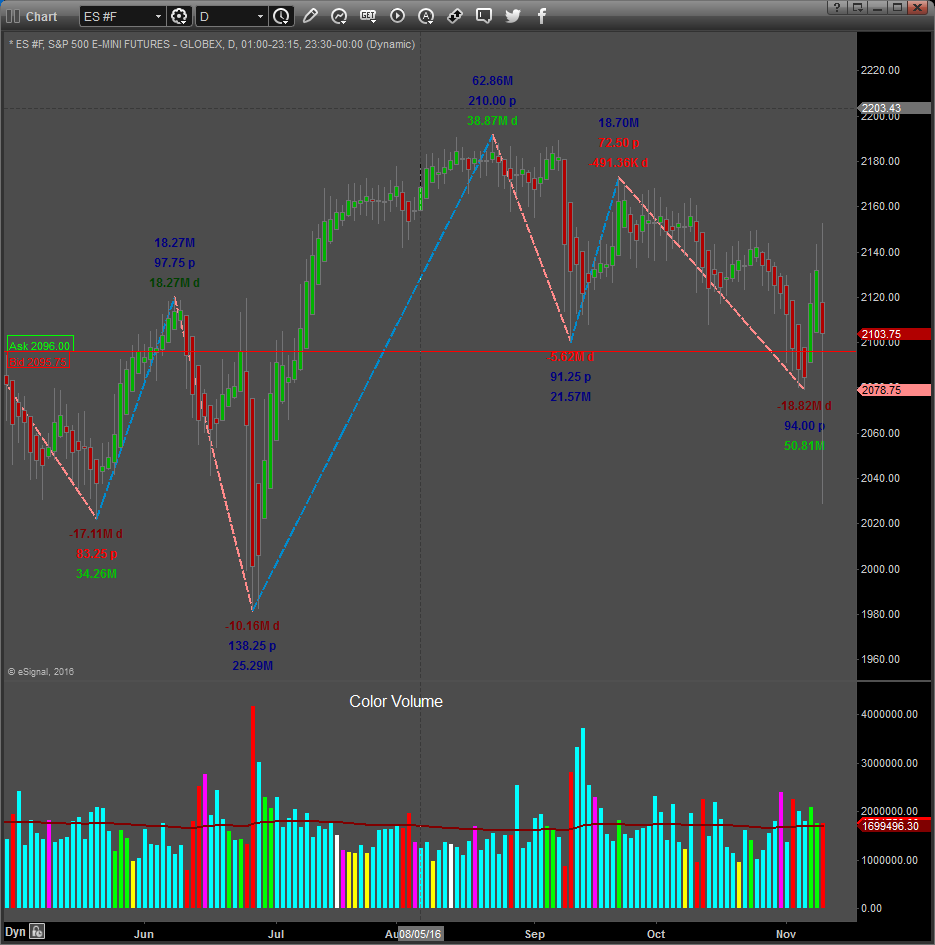

Assessments / Blog 2018-06-14 ES #F Supply stepped in The 3-day and daily charts above show our SUPPLY and DEMAND Dashboard and BXB (Bar by Bar) Signals. The readings are an independent assessment of the one and only measureable fundamental market mover: SUPPLY and DEMAND. It does not matter if price is influenced by a geopolitical event, seasonality, fundamental economic data releases or sentiment driven news, etc. It all reflects in Supply and Demand, the “footprints” of the “Big Boys” or “Smart Money”. Click here for example of reversal trade taken in Feeder Cattle that can be found on this page. In our previous assessment we noted: “Demand has weakened on the Daily chart and the 3-Day and Weekly charts still show Supply is dominating”. We also mentioned: “A pullback in the near term seems likely”. Yesterday the ES dropped 8.75-points to close at 2779.50. At the time of this writing the ES is trading at 2774. Support should come in at the 2767 to 2756 area, if the pullback moves that deep. The final clue that weakness is developing, came after the 3-day bar closed on the 12th. Supply was dominating overall (-0.4 reading) on a bar that closed up 16.00-points, showing more Selling (supply dominating) on the advance, with Supply direction pointing downwards, and Sup/Dem Volatility for the bar pointing downwards. The first clues came on the 8th on the Daily chart, when we saw a Kamikaze-pattern on an up bar, with very low volume and Divergences to the down side on both the Simplified Volume Oscillator which measures Buying and Selling pressure and the Supply / Demand sentiment Tool. After the Smart money up bar on the 12th, Supply started to dominate on the daily bar and price consequently went down. Daily Signals June the 13th Dashboard: The Supply and Demand Reading (1st row) came it at -5 with Supply dominating the trading session. Supply and Demand Direction (3nd row) was to the downside (red down triangle), indicating upwards direction, with substantial strength. Average Supply and Demand Volatility (4th row) is still below 100% but weakened considerably. The change in average Volatility from the previous day was negative 35 (Supply) as shown on the right of Sup/Dem Dashboard. BXB Signals: We had a sell signal on the signals board (1st row). Daily Volatility direction (2nd row) was Down (maroon down triangle). The change in daily Volatility from the previous day was negative 104 (Overwhelming Supply) shown on the right of BXB Dashboard. The overall NY Stock market traded Lower for the day (maroon down triangle in 3rd row). 35% of stocks (4th row) traded above there VWAP (Volume Weighted Average Price) compared to the previous day’s 49%, a negative sign for the markets. We are bearish as to the near-term direction, but bullish on the longer term. The current pullback in the near term should find support at the 2767 to 2756 area. Caution: The 3-Day and Weekly charts still show Supply dominating at the time of this writing and the amount of follow through to the down side could be an important indication as to the direction of the next move. A bar close below 2756 could potentially spark more substantial weakness. Intraday We took one opportunity during the last trading session on the 26-minute chart below. Entries and exits are shown with arrows: Strategy is simple, enter when 2 Dashboards align and exit when two opposite triangles on BXB Dashboard appears, shown with arrows on the chart. We do not take trades when the of Supply and Demand Sentiment tool is at or near extremes (over-bought/sold) in the same direction of the possible trade. The last sub window on the chart below shows the Greed / Fear sentiment measurements of Supply and Demand Sentiment tool. Similar to an Oversold / Overbought situation (but without using price related formulas). Link to Facebook Group where these newsletters are also posted regularly. RISK DISCLOSURE: The information delivered here is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, futures or other securities referenced. All references are for illustrative purposes only and are not considered endorsed or recommended for purchase or sale by MC Trading. Trading Forex, Stocks and Options, Futures and any Cryptocurrency, Commodity or ETF contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. MCTrading has taken reasonable measures to ensure the accuracy of the information contained herein and on this website, however MCTrading does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or from an inability to access such information or any delay in or failure of the transmission or receipt of any instruction or notification in connection therewith. |