|

JOIN OUR MAILING LIST |

|

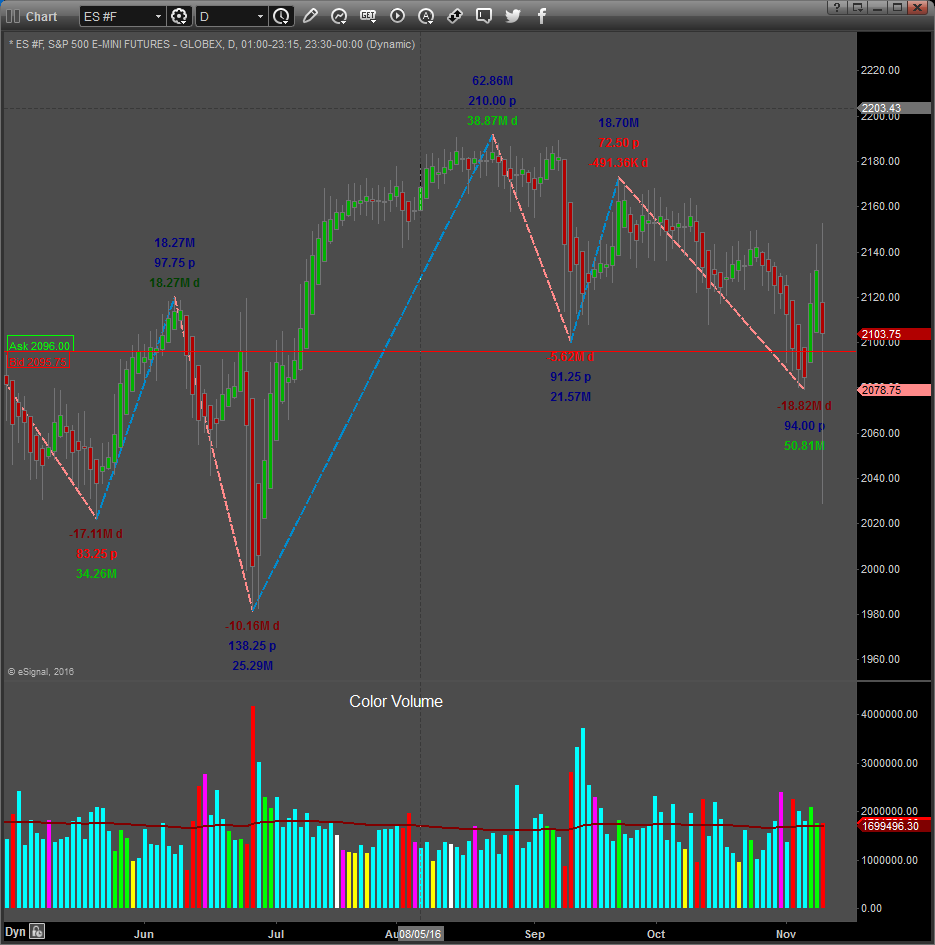

Assessments / Blog 2018-08-18 ES#F Demand in Greed zone The daily chart of the S&P 500 mini futures contract above, shows our proprietary SUPPLY and DEMAND Dashboard and BXB (Bar by Bar) Signals using data from the NYSE. Yesterday the market traded to a low of 2835.00 during the first 50-minutes of the regular trading session, before Demand started to dominate and the market moved to a high of 2857.00. The market closed at 2853.25 above the 2852.75 level mentioned Yesterday. A move above 2863.75 will probably lead to an attempt to take out the January high. The Simplified Volume Oscillator is still in Buying pressure territory, but Demand sentiment is in the “Greed” zone (overbought), making a pullback to the downside a possibility on Monday, before a move higher. NYSE Daily Signals August the 18th Dashboard: The Supply and Demand Reading (1st row) came in at 2.7 with Demand dominating the trading session. Supply and Demand Direction (3nd row) was to the Upside (lime up triangle), indicating upward direction, with substantial strength. Average Supply and Demand Volatility (4th row) was at 71% which is bullish. The change in average Volatility from the previous day was positive 5% (Up) as shown on the right of Sup/Dem Dashboard. BXB Signals: We had no signal on the signals board (1st row). Daily Volatility direction (2nd row) was Down (maroon down triangle). The change in daily Volatility from the previous day was negative 1% (Up) shown on the right of BXB Dashboard. The overall NY Stock market traded Lower for the day (maroon down triangle in 3rd row). 68% of stocks (4th row) traded above there VWAP (Volume Weighted Average Price) compared to the previous day’s 50%, a positive sign for the markets. Caution: Demand sentiment is in the “Greed” zone (overbought), making a pullback to the downside a possibility on Monday. As long as the 2820.00 level holds we should see a move higher from here in the intermediate term. Data is updated in real time during the regular trading session of the NY Stock exchange and does NOT take into account any price indicators or mathematical formulas using price. We do however show the cumulative price change for the trading session and in some instances assess price movement’s relationship to Supply and Demand. It is therefore fair to say that the readings and signals are independent from other popular price indicators and others shown on the chart. The readings are an independent assessment of the one and only measureable fundamental market mover: SUPPLY and DEMAND. It does not matter if price is influenced by a geopolitical event, seasonality, fundamental economic data releases or sentiment driven news, etc. It all reflects in Supply and Demand, the “footprints” of the “Big Boys” or “Smart Money”. Affiliate:

Link to Facebook Group where these assessments are also posted regularly. Click here for example of reversal trade taken in Feeder Cattle that can be found on this page. |