|

JOIN OUR MAILING LIST |

|

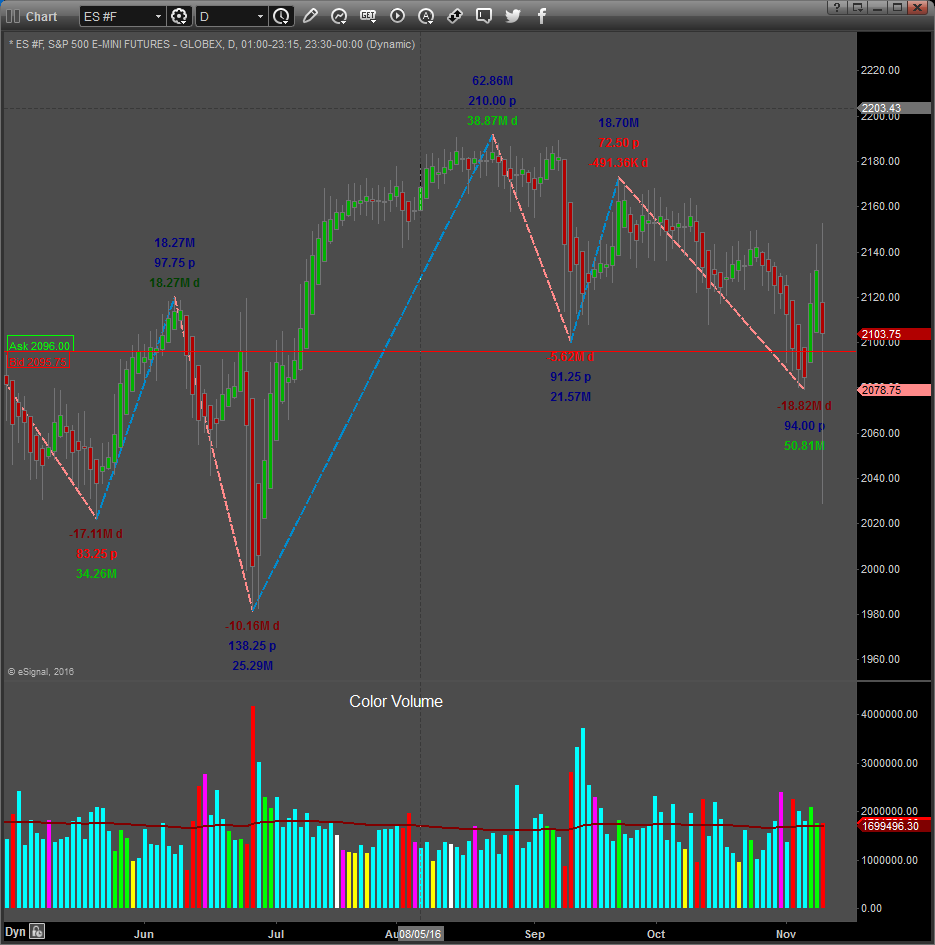

Assessments / Blog 2019-04-28 GC #F Gold set for 1324.70 in 33 days Many experts have pointed out that Precious Metals maybe setting up for an opportunity of a life time in the months to years to follow. On the daily chart above we have drawn an axis line at 1288.70 which is according to our proprietary setup pattern, the “balance point” between Bullish and Bearish conviction. Let’s call it the starting point for attracting strong buying. Buying pressure also started to get the upper hand. The possibility exists the market can experience some resistance to the upside from this level and sell off to a lower level before starting a material advance. A solid close above this level with continued buying pressure should drive the market to around the 1324.70 level in the short term over the next 33 days (end of May), based on our calculation of the expected move according to current volatility: Caution: A bounce to the down side from the current level with some sideways price action is a possibility, before any major advances to the upside materialize. Link to Facebook Group where these assessments are also posted regularly. Links to recent research posts: PRECIOUS METALS GIVE TRADERS ANOTHER OPPORTUNITY THE APRIL 21~24 GOLD CALL IS HERE RISK DISCLOSURE: The information delivered here is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, futures or other securities referenced. All references are for illustrative purposes only and are not considered endorsed or recommended for purchase or sale by MC Trading. Trading Forex, Stocks and Options, Futures and any Cryptocurrency, Commodity or ETF contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. MCTrading has taken reasonable measures to ensure the accuracy of the information contained herein and on this website, however MCTrading does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or from an inability to access such information or any delay in or failure of the transmission or receipt of any instruction or notification in connection therewith. |